Running a WooCommerce store requires preparing monthly tax reports to keep accounting accurate, comply with local tax regulations, and maintain clear financial statements. WooCommerce includes basic reporting, but it does not provide an easy way to filter orders by month, export the necessary tax fields, or generate clean spreadsheets for accountants.

With WP Sheet Editor – WooCommerce Orders, you can quickly filter orders by date range, tax totals, payment methods, countries, and more. Then export only the exact data you need. Instead of manually collecting invoices or sorting through multiple exports, you can create a monthly tax report in minutes.

You can download the plugin here:

Download WooCommerce Orders Spreadsheet Plugin - or - Check the features

This tutorial will show you step-by-step how to filter WooCommerce orders by month and export them for tax preparation.

Why export WooCommerce orders for tax reporting?

Accurate order exports are essential for bookkeeping and compliance. When preparing tax reports, accountants typically need clean data from specific periods. Exporting WooCommerce orders organized by month helps you:

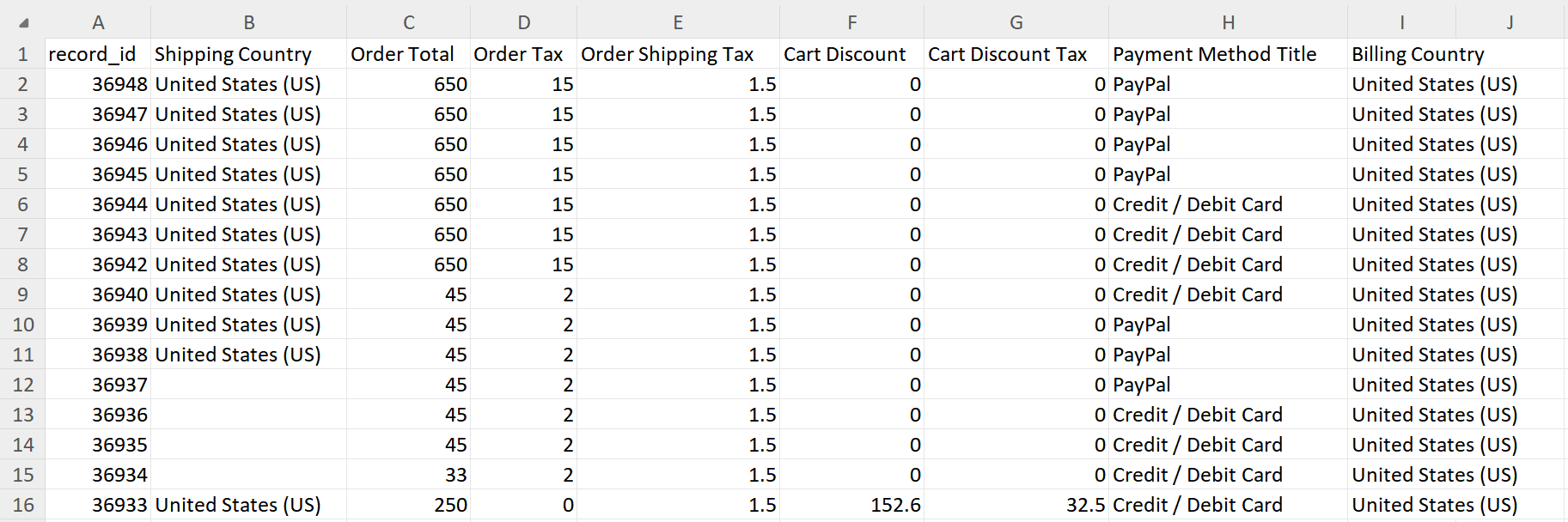

- Calculate monthly taxable revenue using the “Order total”, “Order tax”, and “Shipping tax” fields.

- Provide auditors with detailed documentation of every sale.

- Organize receipts and transactions by month or quarter.

- Simplify end-of-year tax preparation with accurate monthly breakdowns.

- Cross-check payment method totals (Stripe, PayPal, bank transfer, etc.).

- Track international sales for VAT, GST, or other regional tax rules.

Using a spreadsheet tool makes tax compliance easier because you can export the exact fields your accountant needs, without exporting unnecessary data.

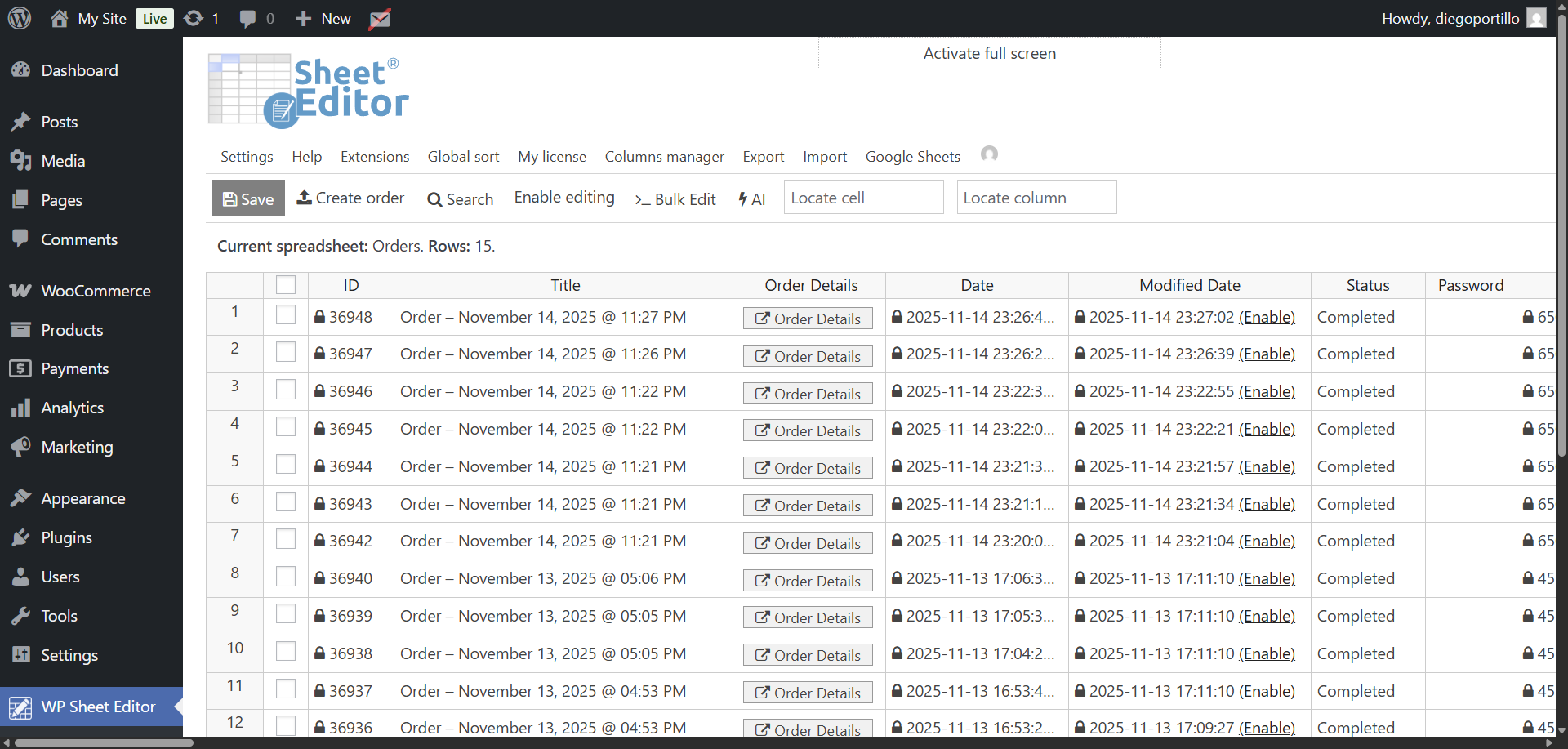

Step 1. Open the WooCommerce Orders spreadsheet

After installing WP Sheet Editor – WooCommerce Orders, go to WP Sheet Editor → Edit orders. Your entire list of WooCommerce orders will appear in a spreadsheet format, allowing you to sort, filter, and edit information with ease.

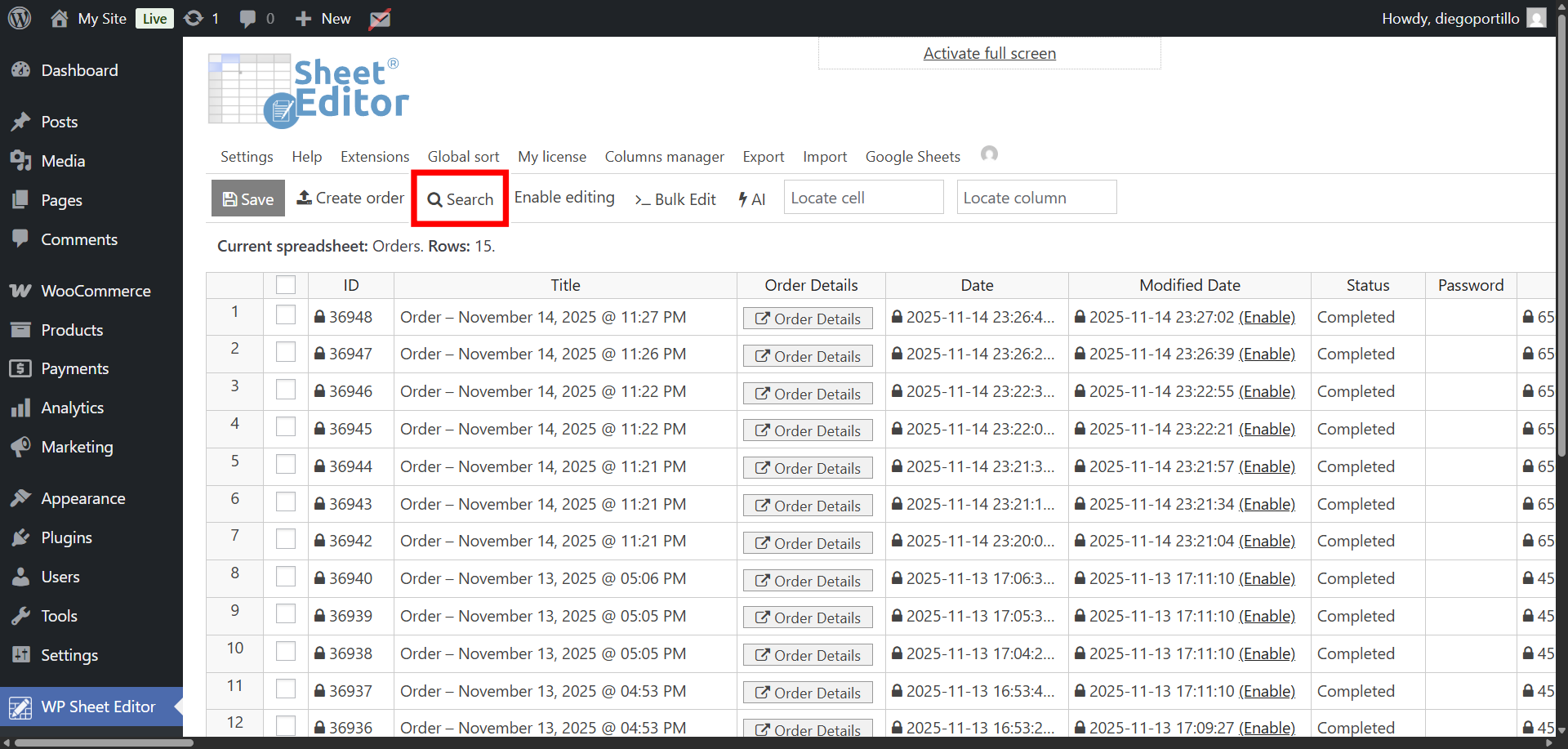

Step 2. Open the “Search” tool

To filter orders for a specific month, click on the Search button in the toolbar. This feature lets you create advanced filters based on dates, amounts, countries, and more.

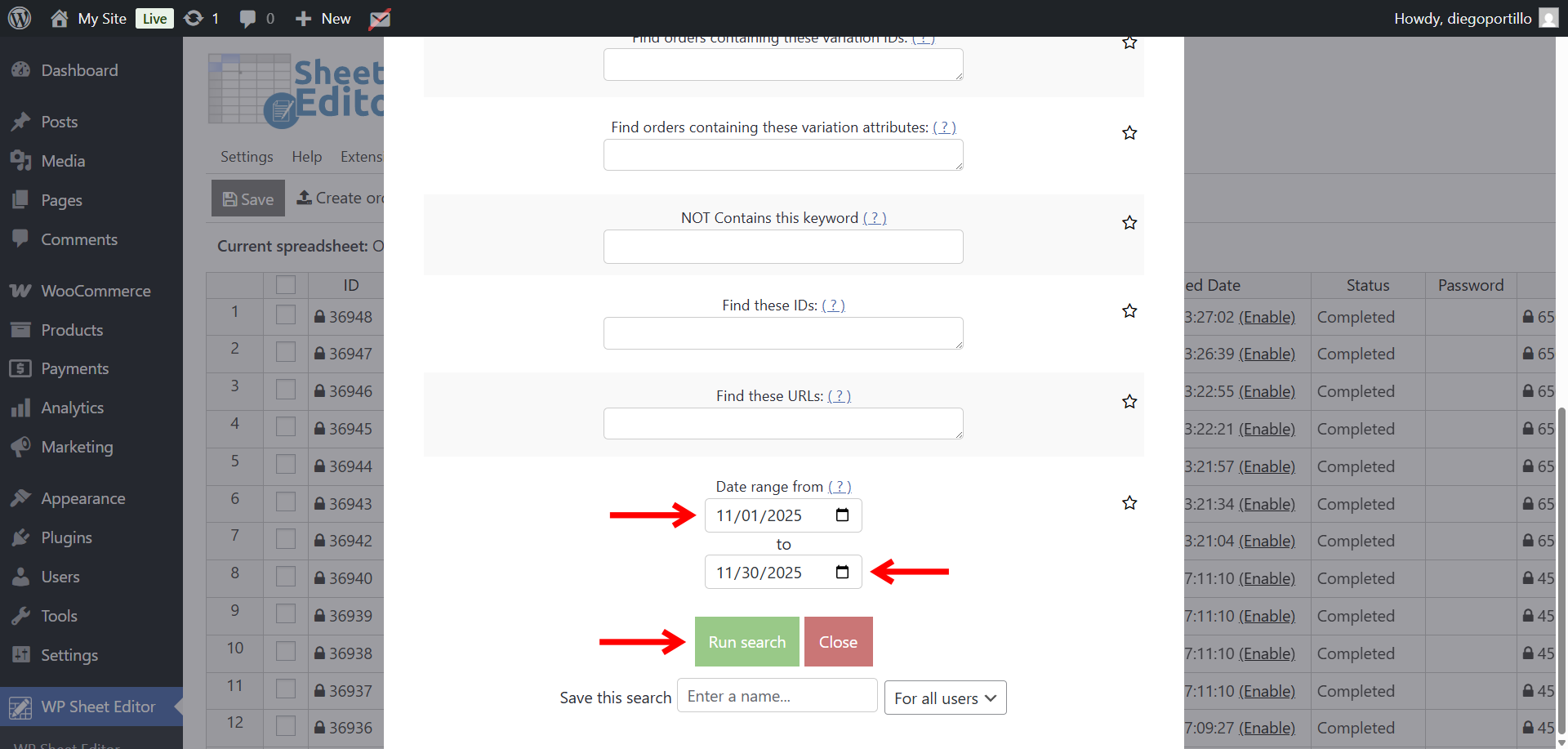

Step 3. Filter orders by month for your tax report

To create your tax report, you’ll first need to retrieve all orders within a specific monthly period. For example:

- All orders from January 2025

- Orders completed between February 1–28

- Orders created last month

- Orders for any custom date range your accountant requires

Inside the Search window, tick the Enable advanced filters checkbos so you can filter orders using a specific date range.

Configure the filter as follows:

- Scroll down to Date range from and select the initial date. For example, 11/01/2025 for November 1, 2025.

- Select the final date in To. For example, 11/30/2025 for November 30, 2025.

- Click on Run search.

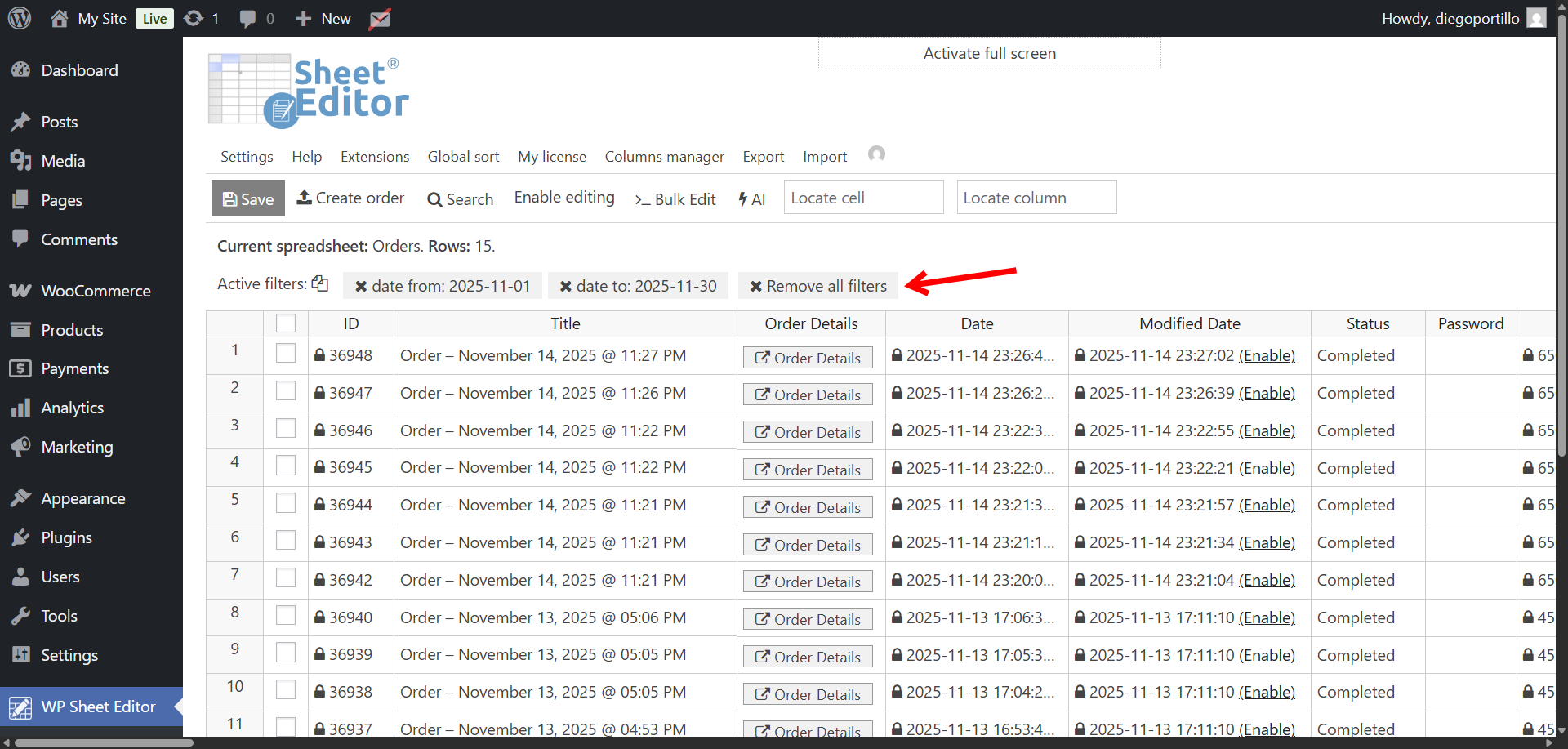

Your spreadsheet will now display only the orders from the selected month.

You can also apply additional filters

Tax agencies sometimes require separating orders by country, payment method, or tax rate. By using the advanced filters (Field | Operator | Value), you can add optional filters, such as:

- Billing country | = | United States, Canada, any other country.

- Order tax | > | 0

- Payment method title | = | Stripe, PayPal, COD, any other payment gateway

- Order currency | = | Your target currency

- Is VAT exempt | = | Yes/No

You can combine as many filters as required to generate a complete tax report for any timeframe or rule.

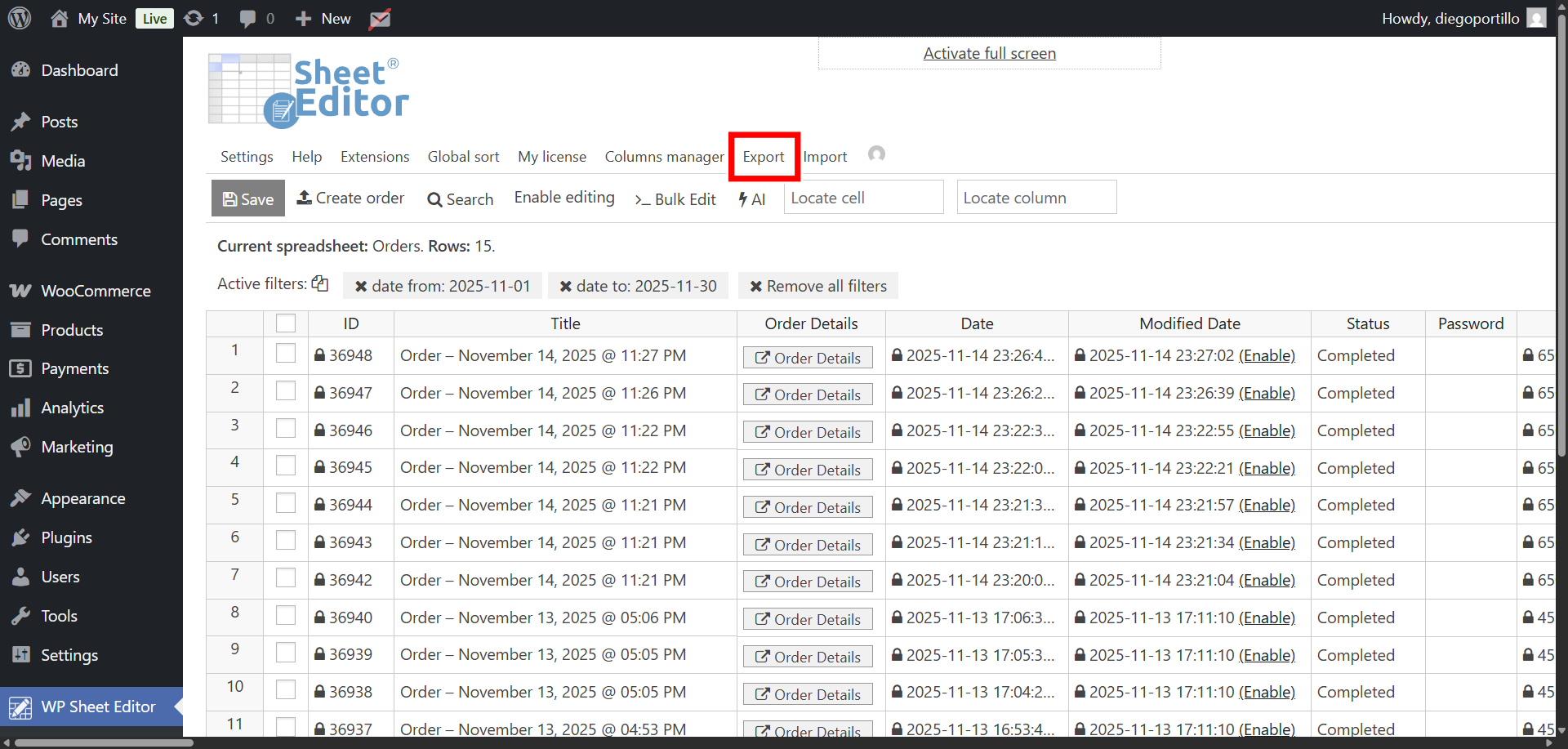

Step 4. Export the monthly tax report

Now that you’ve filtered your WooCommerce orders for the exact month you need, the next step is to export a clean and accurate tax report.

With WP Sheet Editor – WooCommerce Orders, you can generate a professional spreadsheet containing only the orders, taxes, totals, and financial details required by your accountant or tax agency.

This ensures your monthly tax documentation is organized, compliant, and ready for submission in just a few clicks.

To export the filtered orders, click the Export button in the toolbar.

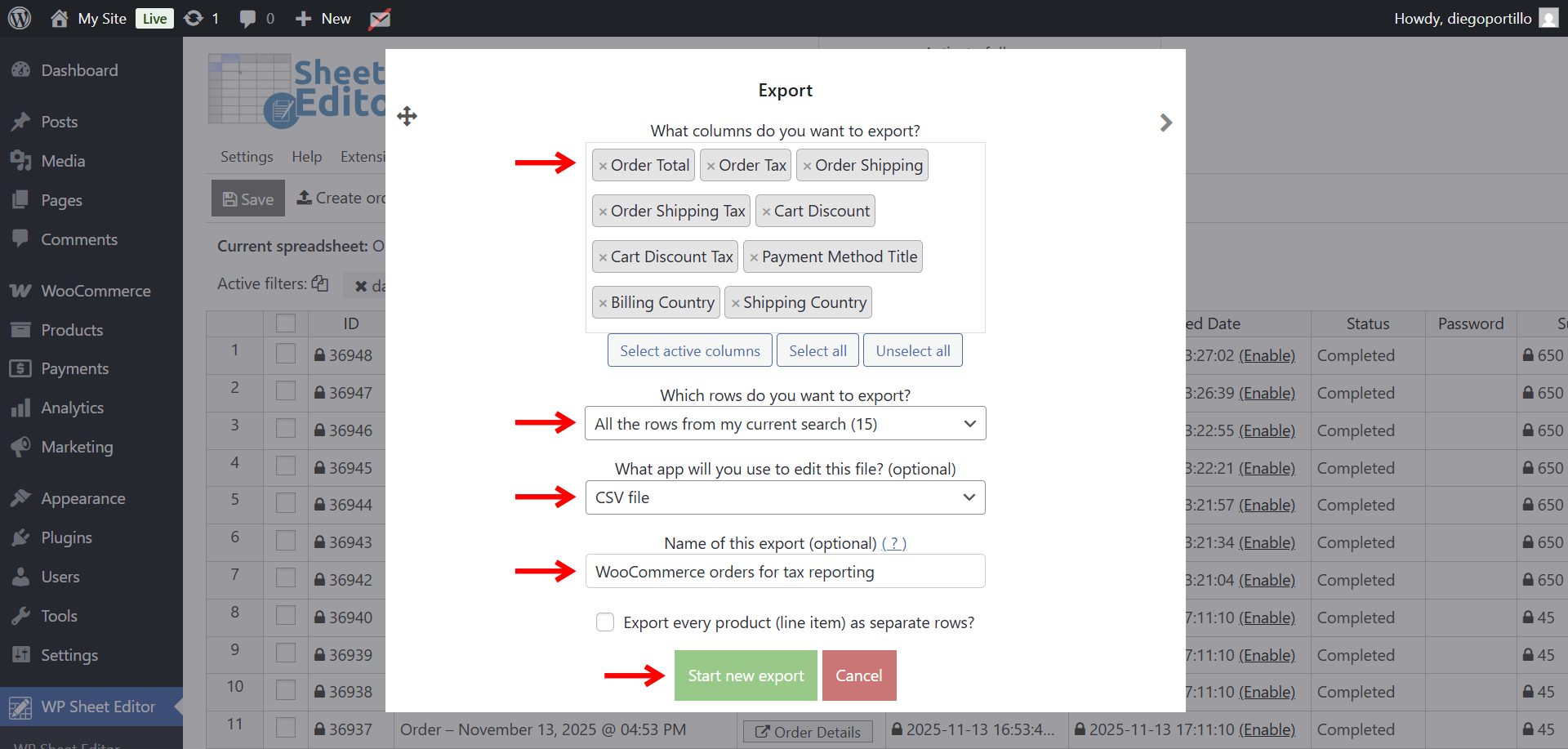

Configure the export by selecting these values:

- What columns do you want to export: You can export all fields/columns or select specific columns like:

- Order total

- Order tax

- Order shipping

- Order shipping tax

- Cart discount

- Cart discount tax

- Payment method title

- Billing country

- Shipping country

- Or any other important field you may need.

- Which rows do you want to export: All the rows from my current search

- What app will you use to edit this field: In this case, we will export it to CSV file, but you can also export it to Excel file.

- Name of this export: Add a name like “WooCommerce orders for tax report”.

- Click on Start new export to generate your file.

You now have a clean, accountant-ready export containing all orders for the selected month, with the exact tax information required.

Exporting WooCommerce orders for monthly tax reports is fast, accurate, and stress-free when using WP Sheet Editor – WooCommerce Orders. Instead of downloading the entire order history and manually filtering dates in Excel, you can:

- Filter orders by month directly in WordPress

- Include only the financial fields required for tax reporting

- Export clean, professional spreadsheets

- Prepare monthly, quarterly, or yearly tax reports in minutes

Use this workflow every month to stay tax-compliant and keep your accounting clean and organized.

You can download the plugin here:

Download WooCommerce Orders Spreadsheet Plugin - or - Check the features